The valuation game: What does it mean?

Learning & Development

300 week ago — 5 min read

Background: The valuation of a company is measured in terms of its pre-money and post-money. Both these parameters are crucial in determining how much a company is worth. Pre-money is basically a measure of how much a startup is worth before it receives any funding from investors and post-money is the worth of a company after it receives money and investments. Anisha Patnaik in her previous article explained whether or not you can grant ESOPs to the co-founder of a company. In this article she shares the strategy behind the valuation game of companies.

In this article, we will be explaining the concepts of investment amount and valuations. The most basic of all concepts in an investment process – if you get these basics right then the rest of the process may become relatively easier (not necessarily painless!)

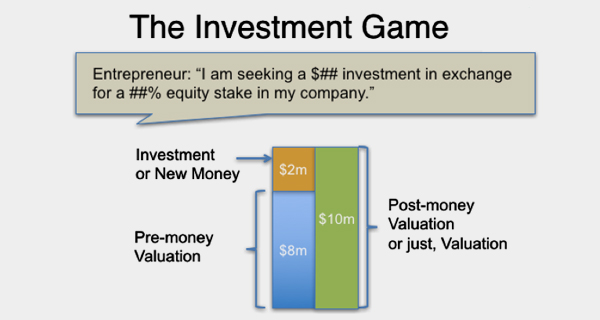

Most investors / VCs and entrepreneurs start the investment game / conversation with a statement that goes something like this:

Entrepreneur: I am seeking a $1m investment in exchange for a 20% equity stake in my company.

Investors: We typically invest $2m (or our 'sweet spot' is $2m) and we take a minority stake in the startup – typically in the mid to high-teens

The investment game

Let us break down the terms in the figure:

- The investment or investment amount is the actual cash amount the investor will put into your company – so it is also called 'new money'

- The pre-money valuation is the value of the company before the investment happens

- The post-money valuation is valuation of the company immediately after the investment happens

The ownership% is the investment amount over the post-money valuation, also referred to as dilution, i.e. we don’t want to give away more than 20% of our company.

Also read: Do team building events really work for small businesses?

Dilution

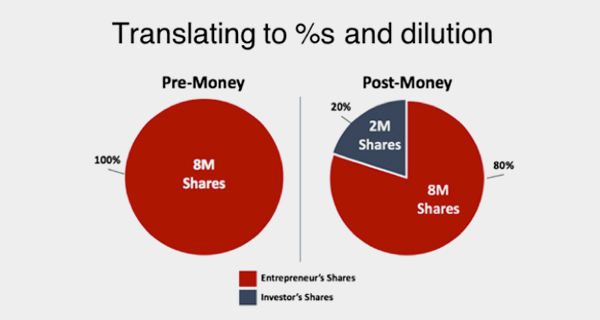

So, what comes first? pre-money, new money, post money or ownership%?

It is the new money!

- The new money is the exact investment amount / the actual cash amount the investor will put into your company; it is also the basis for your business plan.

- The valuation of the company is calculated based on a funded business plan – different amount of funding means different plan – so, it comes after the new money coming in, so, it is called post-money or post-money valuation.

- So, the pre-money valuation – the value of the company before the new money came in – is the post money valuation which is less than the new money – it is a derived number and comes last

- Here you can see that the promoter ownership got diluted from 100% to 80%, or by 20%. Remember the promoters did not sell any shares, the company issued new shares which diluted the promoters’ ownership.

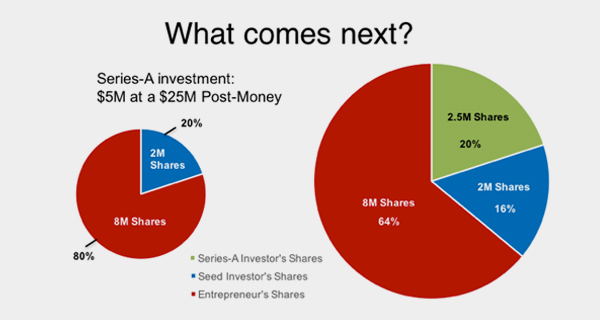

Once the money is in – it is old money. So, now when a new investment comes in the old investor’s share gets the same dilution as the promoter shares. Take a few minutes and work through this next round of investment – $5M new-money for a $25M post-money.

Also read: Money does not motivate people, this does!

- Ownership the new investor or new money gets is 5/25 or 20%

- So the older ownership stakes gets diluted by 20% – i.e. reduced by a multiple of 80% or .8 – so, 80% becomes 64% and 20% becomes 16%

- Pre-money is $20M – so with the new round the value of the holders of the old shares went from $10M to $20M – i.e. the value doubled

- The value of the company went from $10M to $25M or 2.5x

That jump in valuation is what each investor is looking for when they invest into their company with an expectation of what the eventual return would be for them and when. All the investment terms that go alongside the valuation and ownership are linked to the differences in yours and their expectations or around the risks of ensuring some minimum returns.

So, how much equity should an investor get for funding a business?Exactly what his investment amount will buy him over the post-money valuation that you agree to create using the funding (investment amount)!

Also read: How SMEs can succeed in a digital world

To explore business opportunities, link with me by clicking on the 'Connect' button on my eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Network with SMEs mentioned in this article

View Anisha 's profile

Most read this week

Comments (1)

Share this content

Please login or Register to join the discussion