RBI’s New Regulations Make it Easier for Startups to Raise Foreign Funds

Business Development

473 week ago — 3 min read

In its recently released Sixth Bi-monthly Monetary Policy Statement for 2015-16, the Reserve Bank of India, announced the steps being taken in keeping with the government’s initiatives to promote the ease of doing business and contribute to an eco-system conducive for growth of entrepreneurship, particularly in respect of the startups.

RBI announced the following regulatory changes for easing the cross-border transactions, particularly relating to the operations of the startups, in consultation with the Government of India. Below are the excerpts from the RBI’s recent announcement for regulatory relaxations for startups.

1. Enabling startups, irrespective of the sector in which they are engaged, to receive foreign venture capital investment and also explicitly enabling transfer of shares from Foreign Venture Capital Investors to other residents or non-residents;

2. Permitting, in case of transfer of ownership of a startup, receipt of the consideration amount on a deferred basis as also enabling escrow arrangement or indemnity arrangement up to a period of 18 months;

3. Enabling online submission of A2 forms for outward remittances on the basis of the form alone or with document(s) upload/submission, depending on the nature of remittance; and

4. Simplifying the process for dealing with delayed reporting of Foreign Direct Investment (FDI) related transaction by building a penalty structure into the regulations itself.

5. The notifications/circulars under Foreign Exchange Management Act (FEMA), wherever necessary, will be issued shortly.

In addition, the following proposals are under consideration:

1. Permitting startups to access rupee loans under External Commercial Borrowing (ECB) framework with relaxations in respect of eligible lenders, etc.;

2. Issuance of innovative FDI instruments like convertible notes by startups; and

3. Streamlining of overseas investment operations for the start-up enterprises.

Other issues that are permissible under the existing regime including issue of shares without cash payment through sweat equity or against any legitimate payment owed by the company remittance of which does not require any permission under FEMA and collection of payments by startups on behalf of their subsidiaries abroad.

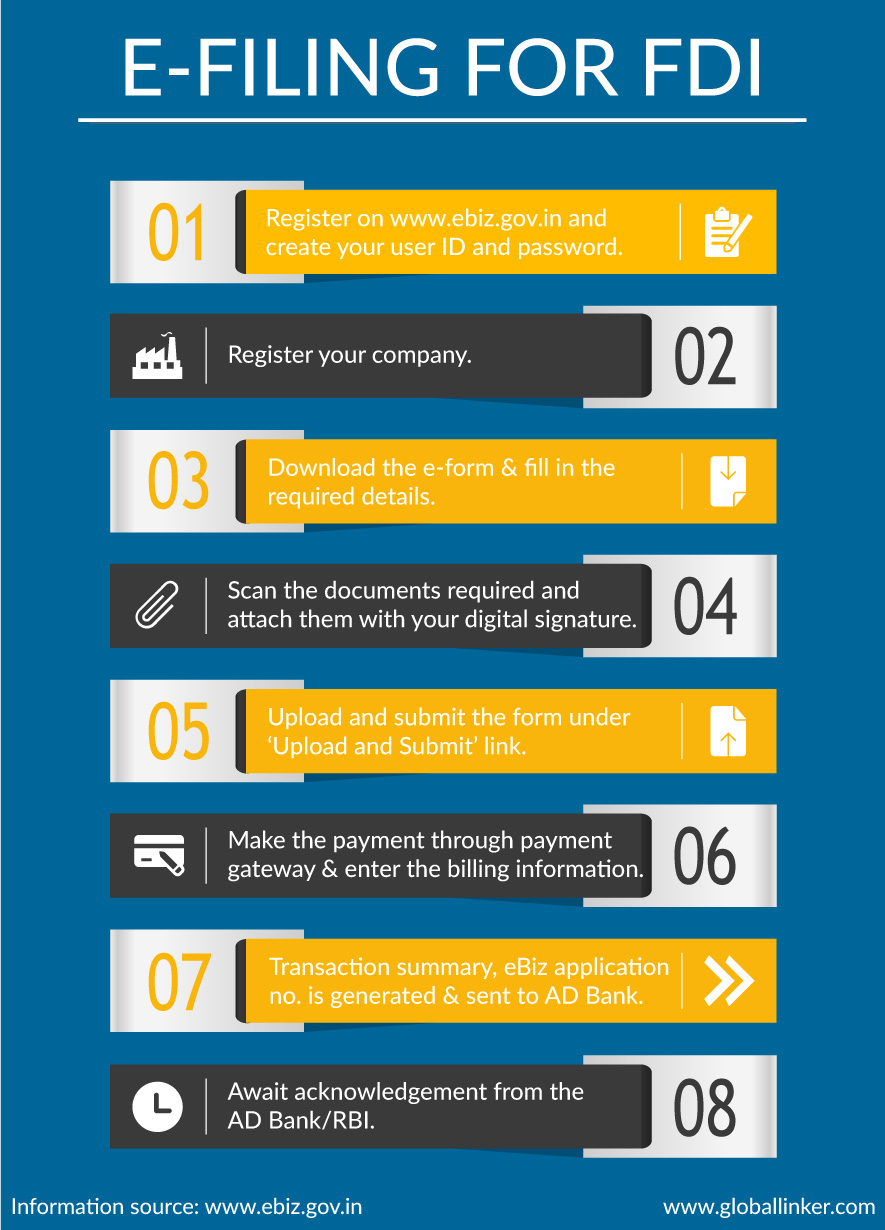

The Reserve Bank has also created a dedicated mailbox, helpstartup@rbi.org.in, to provide assistance and guidance to the startup sector. Further, electronic reporting of investment and subsequent transactions will be made on eBiz platform only. Submission of physical forms has been discontinued with effect from February 8, 2016.

Below is the procedure of e-filing for FDI through RBI’s eBiz portal:

Posted by

GlobalLinker StaffWe are a team of experienced industry professionals committed to sharing our knowledge and skills with small & medium enterprises.

View GlobalLinker 's profile

Other articles written by GlobalLinker Staff

Guide on Selecting the Right IT Products for SMEs

22 hours ago

Best Practices for Procurement of IT Products

22 hours ago

Most read this week

Comments

Please login or Register to join the discussion