Managing funds for survival: A disciplined approach

Finance & Accounting

254 week ago — 9 min read

COVID 19- What’s the impact?

The world that we knew before COVID-19 hit us has ceased to exist. Disruptions in supply chains, distribution, ways of working have had many impacts. Let’s explore a few. We are witnessing a scenario of no demand and supply for most goods and services, save the essentials and healthcare.

Companies that have seen steady sales are now witnessing a time where the consumer's top priority is cash conservation.

A case in point is an organisation like Maruti Suzuki; never have they been in a situation of nil sales. This April, they booked zero sales! Faced with these challenges, companies have no alternative than to dip into their cash reserves.

We are now witnessing an unprecedented level of localised consumption, more so in the rural areas due to the sudden shift in population. This reverse migration has triggered the high possibility of resource crunch in urban areas versus surplus in rural areas, thus creating high volatility of income and cost of labour.

Businesses should regularly assess continuity, irrespective of crisis situations. This is a period of survival of the fittest and the quickest. Only those who are able to rightly assess the situation rapidly will be able to stay ahead of the curve.

This reverse migration of blue-collared resources is going to increase the cost of labour for businesses.

The euphoric business models built pre-COVID can be disrupted in this climate due to the many challenges of managing and raising funds.

Also read: Covid-19 Business Unusual: How should SMEs tackle it?

The larger question looms: How do businesses remain solvent?

We would recommend that companies proactively take the following three steps to manage funds for survival:

- Business continuity planning

- Re-writing the business plan

- Prioritising survival

Business continuity planning

We recommend that start with assessing the impact of COVID-19 on your business. This will ensure that you have not missed out of critical pieces of information. The business environment is changing very rapidly, hence, your plan must lend itself to dealing with these changes with agility. Some points that you must access are:

- Check for all types of financial impact on all the resources in the company/ entity

- Check for operational impact

- Assess customer impact in terms of existence, relationship and future

- Check for legal or regulatory losses, if any

Once you have a clear understanding of the impact, ensure that your business continuity pan includes:

- Identification of the critical resources, systems, facilities, support etc., you will require

- Assessment of the time required to recover after the identification is done

- Checks for financial impact based on the business continuity plan

Businesses should regularly assess continuity, irrespective of crisis situations. This is a period of survival of the fittest and the quickest. Only those who are able to rightly assess the situation rapidly will be able to stay ahead of the curve.

While everyone is hopeful about a quick recovery, post the lockdown, we must prepare for an eventuality that may be different. Demand could continue to fluctuate until we are completely out of the COVID phase. It is prudent to take steps to mitigate any risks.

Businesses must keep in mind that lower cost of production may mean using competitive pricings to get back in the game.

While is makes business sense to increase flexibility by having multiple plans built using scenario analysis, it is also important for businesses to identify synergies and work towards the new normal.

Also read: Business continuity planning - 5 practical tips

Re-writing business plan

Everyone, including the government, should be re-writing their business plan. The aggressive plans made pre-COVID will no longer be of use.

Keep the following points in mind while framing the budget for survival:

- Bottoms-up planning

- Essentials in, non-essentials out

- Costing based on actuals for essentials

- Bottoms-up planning addresses cost before revenue. Keep a sharp eye on costs as business have control over it, while revenue is aspirational.

Consider the following points mind while framing the budget for sustenance:

- Zero based budgeting month-on-month

- Understanding whether the identified expenses are being addressed with the available cash reserves and how long will the burn continue?

- Understanding how much of the same can be funded through sales and what would be the additional impact on cost of acquisition. Can you replace the same with less cost and higher efficiency?

- Planning for minimum sales required after hair-cut for possible inefficiencies, unsupportive market conditions. (Example: Assume a similar environment (new normal) continues for the next 12 months, consider 50% of realistic scenario to be the best-case scenario for 12 months and then plan for 25% hair-cut on the same)

Everyone, including the government, should be re-writing their business plan. The aggressive plans made pre-COVID will no longer be of use.

Refer to the earlier Maruti Suzuki example, where they made a sale of 86,000 crores in the last fiscal, and they are expected to fall short by at least 10% this year if they were to meet the same numbers. While they can reduce their expense with respect to their contract labourers; they would still have to bear the infrastructure, employee and marketing cost. They would also need to plan for 25% hair-cut of their current best-case to be prudent.

Prioritise for survival

Cost of labour is expected to shoot up. With the V-shaped recovery, businesses will have to pay more. 85% of the truck drivers have returned to their home towns, some have been retained by paying 20-30% more.

It is important to grade and rate the debtors. It is equally important to negotiate on the payables.

Several large corporates give big contracts to the SMEs but with 90-180 payment days. Companies must check their financials from the MCA website and negotiate better terms with them.

With high liquidity, the interest rates are bound to drop. Government schemes may offer relief. The time is ripe to negotiate better rates with banks. In this environment banks are now going to depend on cash flow rather than collateral.

It is important to sell your inventory at a discount or even forego the profit and sell at cost to enable sales to fund part of the expenses.

During the financial crisis of 2008-09, banks had stopped lending. Some of them still exceeded the previous year’s profit by focusing on collections. Similarly, businesses can use bill discounting facilities to ensure collections.

Understand how long your cash reserves will last and if there is a working capital facility that can address the cash crunch.

Different audience, different views

As the going gets tough, expect investors to become tougher. Expect bankers and other investors to want a deeper understanding of the business cash-flow. The questions on debtors, creditors, inventory and non-productive investments are bound to be tougher.

Owners should critically evaluate their own performance w.r.t actual cash sales versus sales to understand risks in the business.

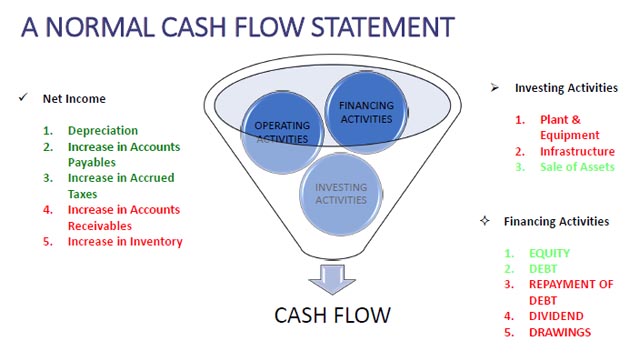

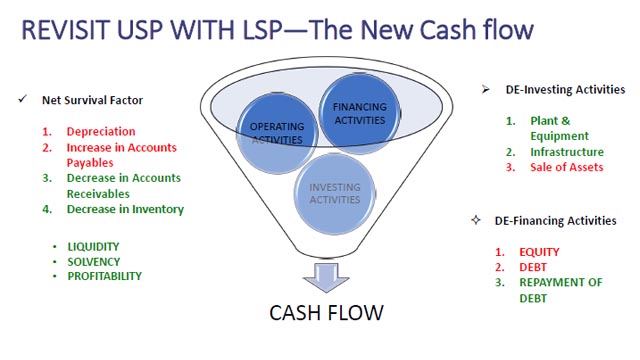

Cash flow statement

Cash Flow Statement is of utmost importance and needs to be prepared every month to gauge impact. We recommend that businesses concentrate on liquidity, solvency, and profitability. Liquidity will enable continuity; solvency will enhance trust and profitability will instill investor confidence. Now is not the time to make investments in plant and equipment or infrastructure.

Businesses need to remain highly focused on business continuity and getting their business plan right to remain solvent and move ahead of the curve. Being agile and responsive to this new normal will set the stage for tomorrow.

Also read: Managing cash flows during a period of crisis

We would love to hear from you!

Do reach out to us on this link or write to Ramakrishnan Venkateswaran if you have any questions or comments on the article.

Image source: shutterstock.com

To explore business opportunities, link with me by clicking on the 'Connect' button on my eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Posted by

Ramakrishnan VenkateswaranExpert Advisor and Consultant for SMEs on the platform, specially to address queries on the impact of COVID-19 on business owners in India With more than two decades of...

View Ramakrishnan 's profile

Other articles written by Ramakrishnan Venkateswaran

Most read this week

Trending

Ecommerce 4 days ago

Comments

Share this content

Please login or Register to join the discussion