Guide to IEC (Importer Exporter Code): FAQs

Export Sector

Federation of Indian Export Organisations

141 week ago — 6 min read

The Importer Exporter Code (IEC) is a ten digit number granted by the Directorate General of Foreign Trade under Ministry of Commerce and Industry, to any bonafide person/ company for carrying out import/export. Below are some clarifications in the form of FAQs about the IEC Code which is necessary for importing and/or exporting.

1. What is the IEC?

IEC or Importer Exporter Code is a unique 10 digit code issued by DGFT – Director General of Foreign Trade, Ministry of Commerce, Government of India to Indian Companies and individuals to enable them carry International Trade. This numeric code is issued on the basis of the PAN of the entity.

2. Why is the IEC required?

To import or export in India, IEC Code is mandatory. No person or entity shall make any Import or Export without IEC Code number, unless specifically exempted.

3. Who can get an IEC?

An individual or a company who wants to do international business can get an IEC. Individuals can use either the name of their company or their name directly to apply for IEC.

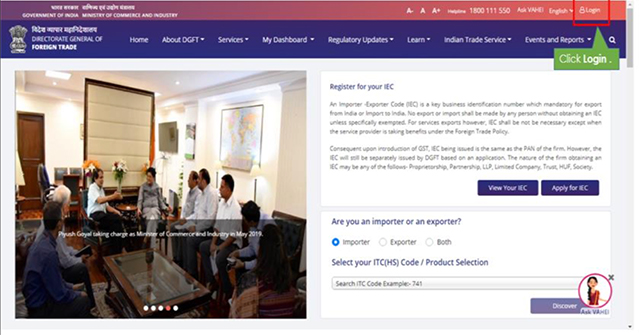

- Visit the DGFT website and login. To register you may follow these steps. Click on Login.

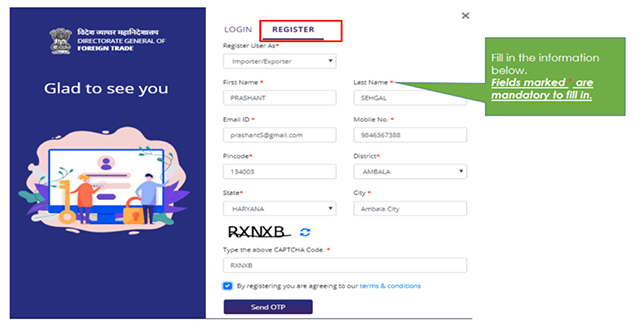

- Enter Registration details.

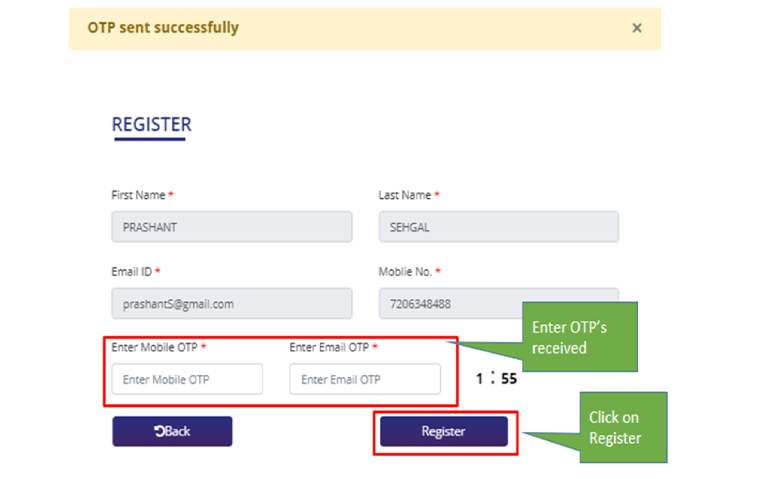

- Enter the OTP received on Email & Mobile. Upon successful validation of the OTP, you shall receive a notification containing the temporary password which you need to change upon first login.

- Next you can proceed with clicking on Apply for IEC.

- After Linking to IEC or Application of IEC proceed with Register Digital signature details through navigating to My Dashboard >> View and Register Digital Signature Token

- Read the information and ensure all prerequisites for Digital signature are met and then click on “Register New DSC”.

- Select and proceed with your digital signature details

- After successful signing, success message is displayed.

- Once user successfully register the Digital signature details then you can view the digital signature details under current digital signature details, and you can perform any action on IEC with the active Digital Signature.

11. What is the validity of IEC?

Also read: How to start an export business

To explore business opportunities, link with me by clicking on the 'Invite' button on our eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Posted by

Federation of Indian Export OrganisationsFIEO is the apex international trade promotion organisation of India. Directly and indirectly it represents the interest of over 200,000 exporters in India. FIEO has 17 offices in...

View Federation of Indian 's profile

SME Inspirations

Most read this week

Comments

Please login or Register to join the discussion