Applying for a business loan? Here are eleven things to know

Finance & Accounting

407 week ago — 5 min read

Planning to get a business loan? Know these important things first.

With the advent of online lending platforms, getting finance for their businesses has now become much simpler for entrepreneurs. The online loan process is faster, safer and offers the benefit of a wider choice of financing.

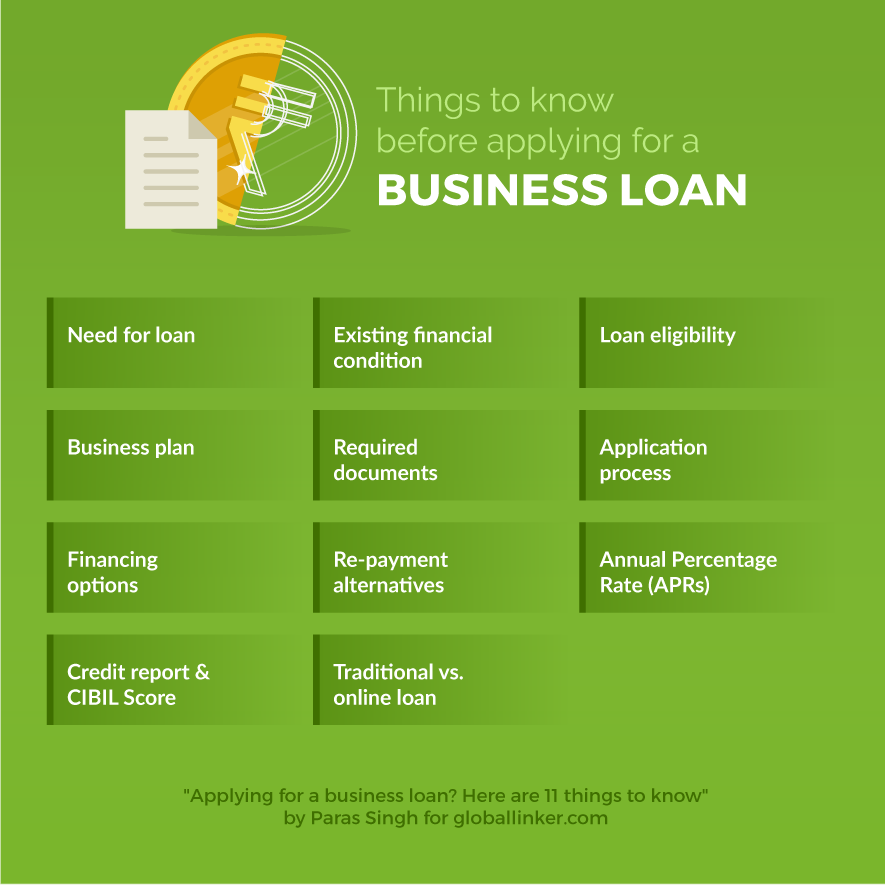

However, there are still certain things every business owner should know before obtaining a business loan, and here are 11 of those:

1. Know your need

Do you need funding for stocking up new inventory, renovating your office space, marketing expenses, expanding your business or other purposes? Firstly, identify your business need to get an estimate of how much money you need. Taking a much higher or lesser amount than your requirement isn't a good choice. Also, lenders will take you more seriously when you're clear about your needs.

2. Know your financial condition

You should know where you stand financially before considering a business loan. Figure out how much money you save each month after deducting all your business expenses (bills, payable salaries, vendor payments, etc.) from incoming money (through sales, payment receivables, etc.).

Also, keep an account of the personal and business assets owned by you which can be provided as collateral, can be sold or given on lease in the wake of a cash crunch. Doing this will help you in analysing how much amount you can afford to pay as EMI every month.

3. Know your eligibility

Once you understand your need and financial situation, the next important thing is that you should be aware of is your loan eligibility. Every lender, bank or NBFC has its own set of parameters to decide whether an applicant is eligible for obtaining a business loan. Some most common criteria are – an applicant's credit standing, age, nature of business, turnover, years of business continuity and others.

4. Know your business plan

If you’re approaching a lender for the first time for a business loan, you must have a detailed business plan ready to show. Lenders will know that you're serious about your plans and will be able to analyse how you're going to repay the loan amount.

5. Know which documents you require

Before you extend your application to the lender, gather all the required documents (such as identity/ age/ address proof, business licenses, bank statements, etc.) with their photocopies. The lenders will need them for verification to process your loan.

6. Know the application process

How will you get a loan if you don't know how to apply for it? The process broadly includes three sub-processes - submitting the loan application with all the required documents, getting approval from the lending institute or bank, and receiving funds through cheque or bank transfer.

7. Know various financing options

Make sure you're aware of all funding options (secured and unsecured business both) to compare and choose the best according to your needs. Loan against property, loan against credit card receivables, loan against financial securities or shares and term loans are some common business financing alternatives.

8. Know re-payment alternatives

You should be aware of various repayment options provided by the lenders. You can repay your loan weekly or monthly or through balloon payment rule, depending on your business cash inflow.

9. Know about APRs

The Annual Percentage Rate (APR) is a vital factor to look for when comparing lenders. APR gives borrowers a combined annual rate for their loan, including the fees and interest.

10. Know your credit report and CIBIL score

Your lender will analyse your credit worthiness by verifying your credit history. If you don't have collateral/ asset to be provided as security, then your CIBIL score plays a significant role in deciding your loan eligibility and the amount you can avail. Hence, you should know your credit report, and CIBIL score before applying for a business loan and if it's not satisfactory or if there's any error in there, fix it before extending your loan application. However, improvement in the credit score takes time, so plan your actions well in advance.

11. Know the best way to obtain financing

You can avail business financing either through traditional lending or online lending through fintech business lending platforms. The latter has many benefits such as better and wider access to funding options, enhanced speed, the convenience of a paperless loan process, e-approval, online loan disbursal and so on.

It is advised to know all these things and prepare yourself before approaching the lenders and applying for business funding.

Seek business funding at the right time and with due planning to keep your business growing!

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

View Paras 's profile

SME Inspirations

Other articles written by Paras Singh

The impact of GST on industries & consumers

394 week ago

Benefits of obtaining a pre-approved loan

398 week ago

Most read this week

Trending

Ecommerce 2 days ago

Comments

Please login or Register to join the discussion